News and Updates

Co-ordination of benefits

You’ve heard it before, “Be sure to co-ordinate your benefits to maximize your coverage and claim amounts.” But what does it mean to you and your family?

Co-ordinating your benefits is an important step when setting up your benefits to maximize your coverage. If you have more than one family benefits plan, co-ordination could mean you get more money back for your health and dental costs.

Before you get any money back, reasonable and customary limitations, coinsurance/reimbursement, deductibles and/or maximums apply as per the terms and conditions in each plan (refer to your benefits booklet).

If you are covered under one benefits plan only, then co-ordination of benefits does not apply to you.

How it works

When you and/or your spouse submits a claim, you send it to your own plan first. Then, if there is an unpaid amount, it can be sent to another plan for consideration and/or payment.

Basic guidelines for submitting claims between two benefits plans

|

Claim is for |

First |

For any unpaid amount |

|

You |

Submit claim to OTIP |

If you have benefits with another benefits plan (e.g. spouse’s plan)

|

|

Your spouse |

Submits claim to their insurance company |

If your spouse has benefits with your plan

|

|

Your children |

The parent who has the earlier birth month and day will be the first person to send in the claim |

The other parent can send in a claim for any unpaid amount to their insurance company (see above steps). |

|

Example: |

|

Ready to co-ordinate your benefits plans?

Co-ordination of benefits is first set up in My Benefits and then every time you submit a claim in My Claims.

How to setup co-ordination in My Benefits

To help us process your claims properly, you need to tell us if you and/or your family members have benefits with another insurance plan.

You must set it up once, and then update if you need to add or remove people covered under your plan.

Follow these steps: How do I set up co-ordination of benefits in My Benefits?

How to co-ordinate claims in My Claims

We want to make co-ordinating your benefits as easy as possible.

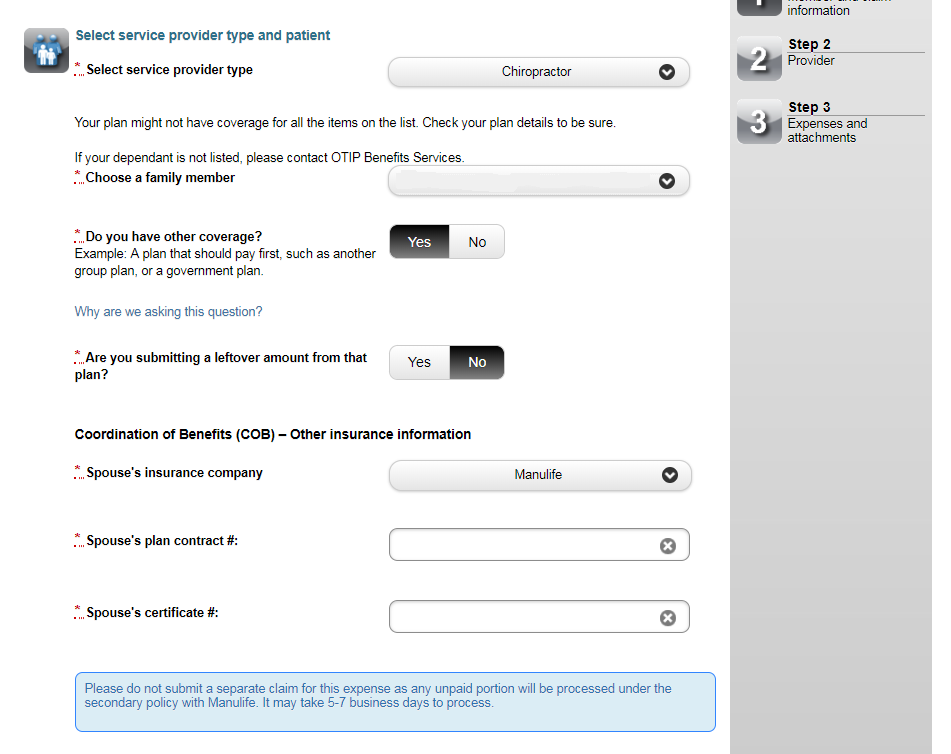

If your spouse’s insurance company is also with Manulife (or they have benefits with the same or another Employee Life and Health Trust (ELHT) where Manulife is also the insurer), co-ordination of benefits is done automatically for you if you enter your spouse’s plan contract and certificate numbers when you submit a claim. It may take five to seven business days for the claim to be processed.

If the other plan is with a different insurance company, their plan information is not needed. For any unpaid amount, you can submit directly to the other insurance company.

Follow these steps: How do I submit claims online

Tips:

- Benefits will not be automatically co-ordinated if submitted by providers.

- When submitting your claim through My Claims, remember to identify that you have other coverage (see image below).

Here are tips to answering the above questions “Do you have other coverage?” and “Are you submitting a leftover amount from that plan?”:

When you submit a claim online

|

Both benefits plans are with the same or another ELHT (both plans insured by Manulife) |

ELHT Benefits Plan is insured by Manulife; the other plan is not insured by Manulife |

|

For these questions, you would click as follows: |

For these questions, you would answer as follows:

***** |

When the provider submits

|

Both benefits plans are with the same or another ELHT (both plans insured by Manulife) |

ELHT Benefits Plan is insured by Manulife; the other plan is not insured by Manulife |

|

Since the service provider has submitted your claim directly to Manulife, no action is required from you. |

For these questions, you would answer as follows:

NOTE: If pharmacist is not able to submit to either plans, you may need to submit the unpaid amount online or by paper. |

When you submit a paper claim

|

The above questions do not apply to you if you send in paper claims. |

FAQs

How do the two benefits plans calculate how much is paid back to members?

According to the Canadian Life and Health Insurance Association (CLHIA):

The plan that pays first will calculate payments as though another plan does not exist. This means you are paid back only for the amount that is reasonable and customary minus any co-insurance or deductible as per your plan.

The plan that pays second calculates payments, based on the lowest of:

- The amount that it would have paid if it had paid first, OR

- 100% of the cost minus the amount paid by the first plan

The combined payment from all plans cannot exceed 100% of the eligible medical or dental expenses. In some cases, the combined payment from all plans may be less than what you have paid out of your pocket.

Using the above example, Sasha got $40 back for the massage fee ($80) from his plan. When his spouse submitted the unpaid amount to their plan, the other insurance company calculations were as follows:

- The amount that it would have paid if it had paid first ($64), OR

- 100% of the cost minus the amount paid by the first plan ($40)

Therefore, Sasha got $40 back from his spouse’s plan—getting back 100% of his massage fee.

How do reasonable and customary limitations impact co-ordination of benefits?

Before you get any money back, deductibles, maximums or reasonable and customary apply as per the terms and conditions in each plan (refer to your benefits booklet).

This means you are paid back only for the amount that is reasonable and customary minus any coinsurance\reimbursement or deductible as per your plan.

Once the first insurance company pays the reasonable and customary amount, there may still be an unpaid amount if the service provider was charging more than what is considered reasonable and customary by the first payor. Therefore, depending on your plan coverage, you or your spouse may still end up having to pay a portion of the expense out-of-pocket even if you are covered under more than one benefits plan.

My son is 18-years-old and works full time. His job also give him benefits. Is he covered under my plan?

No, your son would not be covered under your plan and co-ordination of benefits does not apply in this situation. For your son to be covered under your plan, he must meet the following criteria:

- unmarried

- under age 21, or under age 25 if a full-time student

- not employed on a full-time basis

- not eligible for coverage as a member under this or any other group benefits plan

I have remarried and have joint custody of my two kids. How does co-ordination of benefits work between the different health plans (mine, my ex-spouse and my new spouse)?

For this kind of situation, you can call OTIP Benefits Services. We can help you understand how co-ordination of benefits works between all these different plans. We want to ensure you get the best coverage for your family and minimize your out-of-pocket expenses.

When do I need to contact OTIP Benefits Services about co-ordination of benefits?

You can call us if the one of the following situations apply to you:

- When parents are divorced or separated, the parent with full custody would send in the claim first to their insurance company. When there is joint custody, standard co-ordination of benefits applies (refer to the above Basic guidelines for submitting claims between two benefits plans).

- When a student is covered under a student health and dental plan. Student health and/or dental plans will pay the claim first.

Does my province’s health plan (e.g. OHIP) cover some of my expenses?

Your province’s health plan may cover some medical and health expenses.

Before you send us your claim:

- Ask your doctor or health professional if your province’s health plan covers part of the cost.

- If your province’s health plan declines your claim, send us a statement from them that explains their decision. Working with the insurer (Manulife), we will review and process your claim as per the terms and conditions of your benefits plan.

If I have benefits with my Employee Life and Health Trust Benefits Plan, should my spouse keep their benefits plan?

If you have access to more than one family benefits plans, it is a great way to maximize benefits. If you are thinking that you can save money by paying for only one benefits plan, consider how co-ordination of benefits works and what medical expenses you have before signing a waiver and giving up a second plan.

Consider having two benefits plans if the following situations apply to you:

- Married couples or domestic partners who each have access to a benefits plan through their employer

- Children with parents who each have access to a benefits plan and may choose to include the children on each plan

- Adult children (ages 18 – 25) who have coverage through their school and through their parents

If you are covered under one benefits plan only, then co-ordination of benefits does not apply to you.

Do I get double or more benefits if I am covered under more than one plan?

No. The combined payment from all plans cannot exceed 100% of the eligible expense. Co-ordination of benefits with another benefits plan may help cover some of your health and dental costs that are not completely covered under your own plan.

Who is the ELHT, OTIP and the insurer?

|

Plan sponsor: |

Managing and governing the ELHT benefits plan |

|

Plan administrator: |

Administrating the ELHT benefits plan |

|

Insurer: |

Issuing insurance policies and pays the claims |